General information

At some point you will receive a letter from the Regionale Belasting Groep asking you to pay a water tax. This bill is divided in two. One part of the bill is for the wastewater treatment system and the due amount for it is normally of €93.5 , if you live alone and in Den Haag for a year. However, this part of the bill cannot be waived. What can be waived is the second part of the bill which is the user charge for the water system. The due amount for it is of €119.67 if you live alone and in Den Haag for a year.

You can apply for a waiver if:

- You have paid you water tax less than 3 months ago

- You don’t have a savings account

- If your income is at or below the income support level (‘bijstandsniveau’)

For a waiver You will need:

- A complete set of bank statements from the past three months of all your bank accounts (chequing and savings)

- Your health insurance policy

- Most recent proof of rent benefit and health benefit:

- You can find this proof on mijn.toeslagen.nl under ‘Mijn beschikkingen’. The document is called ‘Voorblad’

- This should include at least two proofs of payment

- The most recent rent specification meaning your rent contract and the breakdown of the service costs. You also need to send proof you paid your rent at least twice.

- Send the most recent overview of your income (payroll). Do you have a fluctuating income? Then you have to send the overview of the last three months. If you live in a shared room, you also need to send the other persons documents concerning income.

Starting the procedure

In order to start your procedure for an exemption you will have to ask for an exemption form. You can do that either by phone at (+31)(0)88 291 11 99 or online.

Step 1.

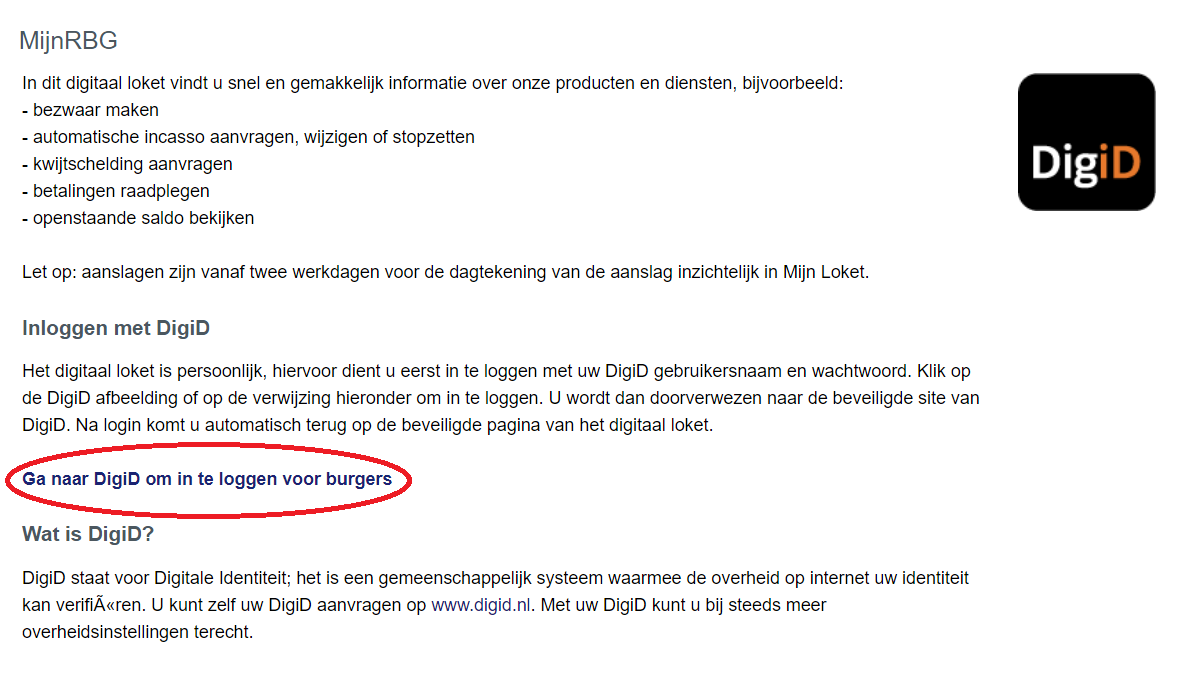

Click on ‘Ga naar DigiD om in te loggen voor burgers’ and log in with your DigiD to connect yourself to mijnrgb.nl.

Step 2.

Step 2.

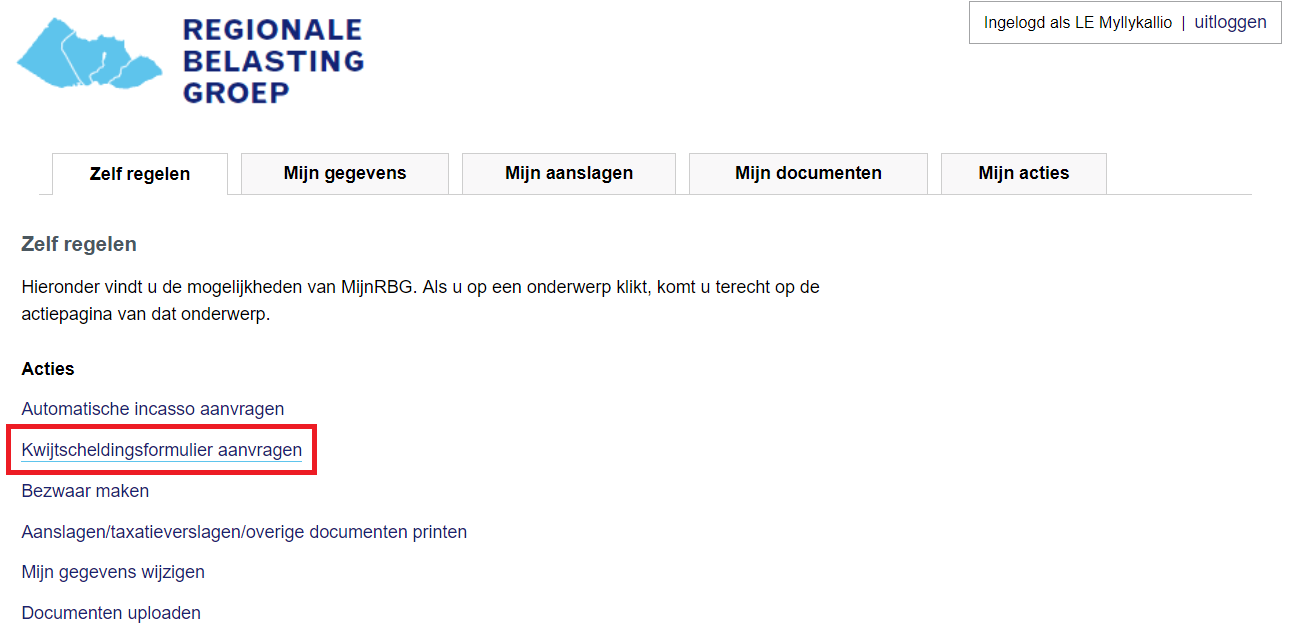

Click on ‘Kwijtscheldingsformulier aanvragen’

Step 3.

Fill in your email and phone number if they ask for it. When you have filled in the information click on ‘Door naar aanvragen kwijscheldingsformulier’.

Step 4.

Click on the bill you wish to waiver.

Step 5.

You can finally fill in the form. Click on ‘nee’ every time.

Finally click on ‘Aanvraag verzenden’:

You will receive the exemption form by mail within two weeks.

Continuing the procedure

The Aanvraagformulier kwijtschelding or exemption form will look like this:

It will contain your name, address and client number, klantnummer

Please, fill in this form with BLACK PEN and BLOCK LETTERS

Step 1.

SINGLE-ROOM SITUATION

- Choose alleenstaande

- You don’t need to fill in anything else

SHARED-ROOM SITUATION

- Choose alleenstaande

- Fill in the initials and last name of your roommate, his/her date of birth, inwoner, and his/her income

- If your roommate receives money from DUO, you should attach a copy of his/her college card to this form

Step 2.

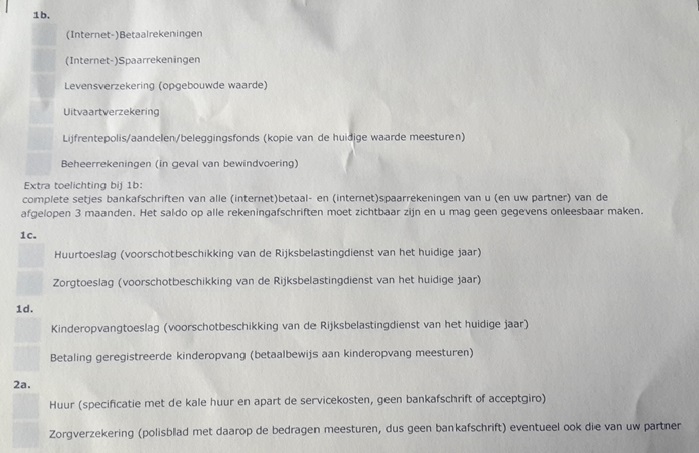

Cross below what applies to you. Please always send a copy of the supporting documents of the questions you have crossed (If this information is not included, the request cannot be processed)

For 1a, tick:

- Inkomsten uit werk if you have an income. You will also need to send three months of payrolls with a fluctuating income, only the most recent payroll with a stable income.

- Vakantiegeld if you work and get your holiday money transferred separately from your income. You will need to add a proof of this to the envelope;

- DUO if you have study financing or a scholarship. You will need to add a proof of this to the envelope;

- Andere inkomsten if you have other official sources of income, such as a dividend or a payment which is not included in your standard income. Living money from your parents is not an official source. You will need to add a proof of this to the envelope;

- Heffingskortingen etc. if you receive any benefits or discounts regarding working related income. You will need to add a proof of this to the envelope;

- Kamerverhuur if you rent out a room. You will need to add a proof of this to the envelope;

For 1b tick:

- Betaalrekeningen for paying accounts. You will need to add all the payments of the last three months to the envelope;

- Spaarrekeningen for saving accounts. You will need to add all the payments of the last three months to the envelope;

- Levensverzekeringen if you have any life insurance. You will need to add a proof of this to the envelope;

- Uitvaartverzekering if you have a funeral insurance. You will need to add a proof of this to the envelope;

- Lijfrentepolis etc. if you have any other have money saved in a fund or the like. You will need to add a proof of this to the envelope;

- Beheerrekeningen if you there is a banking account of a company on your name. You will need to add a proof of this to the envelope.

For 1c tick:

- Huurtoeslag if you receive rent benefit. You will need to add a proof of this to the envelope.

- Zorgtoeslag if you receive health benefit. You will need to add a proof of this to the envelope.

Both the proof of rent benefit and health benefit can be found by logging in to MijnToeslagen, going to ‘Mijn beschikkingen’ and selecting the file ‘Voorblad’. This file shows the details of both benefits.

The boxes of 1d only need the be ticked if you use day care for children and receive benefits for that.

For 2a tick:

- Huur if you rent a house or apartment. Send both your renting contract and a copy of the service costs;

- Zorgverzekering if you have a health insurance. Send a copy of a document with the (financial) details of this insurance (polisblad). Do NOT send a bank transcript.

For 2b tick:

- Terugbetaling if you still have to pay income tax of last year. You will need to add a proof of this to the envelope;

- Auto / motor if you have a vehicle. You will need to add a proof of this to the envelope;

- Overige bezittingen if you own a house, boat, caravan, etc. You will need to add a proof of this to the envelope;

Tick 3 if you are in a debt relief programme.

Step 3.

Fill in your personal data:

- Naam/ name

- Adres/ address

- PC+plaats/ postcode+city

- IBAN/ Bank account number

- Datum/date

- Geboortedatum/ date of birth

- Telefoonnummer/ telephone number

- Aantal bijlagen/ the number of attached documents you are including with this form. It is recommendable to staple together a document that counts multiple pages and count it as one document.

- Handtekening/ your signature.

In the last part of the form there is a statement that translates as ‘By filling in this form, you authorize us to collect information from the Rijksbelastingdienst, the Rijksdienst Wegverkeer and the UWV. If you do not want to authorize the Regionale Belasting Groep, RBG mark an X’

Step 4.

When you are done filling in this form, you should send it with all the attached documents in a ‘sufficiently paid’ (with enough stamps) envelope to:

Regionale Belasting Groep

Postbus 923

3100 AX Schiedam

or

By handing in at the counter of the Regionale Belasting Office in Schiedam (same address).

We strongly recommend calling the official Regionale Belasting Groep telephone (+31)(0)88 291 11 99 if you have any further doubts. Their official web page is not as straightforward as it should be. By calling, you will save a lot of time.

Waste Tax Waiver

Before you start with the procedure, please check whether you have the following documents, either in the form of a hard copy or a digital copy:

- Most recent overview of your income (payroll). Do you have a fluctuating income? Then you have to send the overview of the last three months. If you live in a shared room, you also need to send the other persons documents concerning income

- Declaration of admission at LUC from the year you’re in and a copy of both pages from the Message Study Finances.

- Both sides of your income tax assessment

- Most recent proof of rent benefit and health benefit

- You can find this proof at mijn.toeslagen.nl under ‘Mijn beschikkingen’. The document is called ‘Voorblad’

- This also includes at least two proofs of payment

- Renting contract including the breakdown of the costs

- Overview of the health premium from your insurer (polisblad)

- A proof that shows the balance of all your bank account

Step 1: Go to https://www.denhaag.nl/en/taxes/tax-waiver/tax-waiver-1.htm

Click on “Apply for a tax waiver”

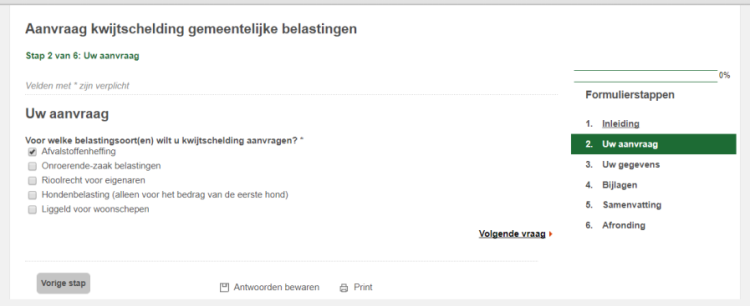

Step 2: Choose which waiver you want to apply for

| Select first waiver “Afvalstoffenheffing” means “waiver for waste tax”.Click “volgende vraag” (next question) to continue. |

Step 3: Fill in the “Biljetnummer” which is in the right corner of the document you received.

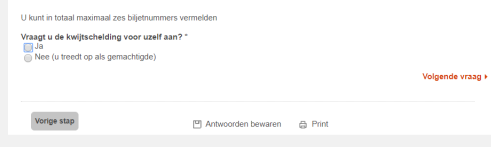

Step 4: Fill in if you request the waiver for yourself.

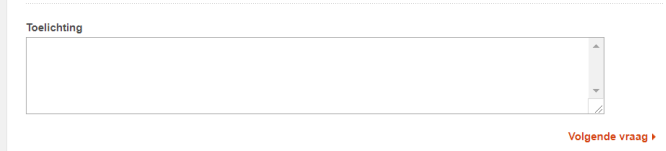

Step 5: Write down if you have anything to add or explain why you request a waiver. This is optional.

Step 6: Fill in with how many persons you live that are 18 years or older.

Step 7: Fill in your income, in euros. Both income of your job and loans need to be considered.

Step 8: Fill in how much study financing you are receiving.

Step 9: Fill in how much pension you have.

Step 10: Fill in how much alimony you receive for adults and children.

Step 11: Fill in the amount of euros of income return tax you received from the state.

Step 12: Fill in the health care allowance you receive.

Step 13: Fill in the rent benefit you receive.

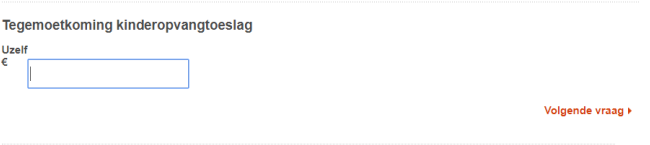

Step 14: Fill in how much day care allowance you receive.

Step 15: Fill in the child bound budget. If you do not have a child, fill in 0.

Step 16: Fill in how much living benefit you receive. You only receive this when you do not receive rental subsidy and when you have applied specifically for it. You can apply for it when the rent is to high compared to your income and you cannot pay it anymore, due to unforeseen circumstances. If this is not the case, fill in 0.

Step 17: Fill in the rent you pay.

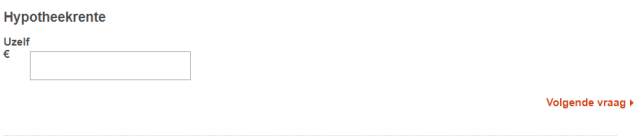

Step 18: Fill in your mortgage. If you have none, fill in 0.

Step 19: Fill in how much money you pay for a piece of land you rent from the owner, which is often the municipality. This is likely not applicable to any LUC student. Fill in 0 when it does not apply to you.

Step 20: Fill in how much allowance you pay for adults and children.

Step 21: Fill in how much you pay for health insurance.

Step 22: Fill in how much you pay for child day care.

Step 23: Fill in whether you or your roommates have a vehicle like a car, caravan or boat.

Step 24: Fill in how much you mortgage you have open on the home you bought. This is likely not applicable to LUC students.

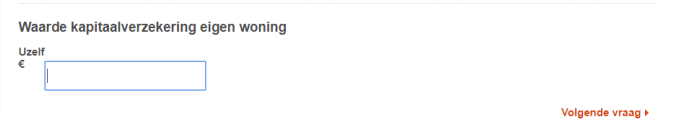

Step 25: Fill in how much your capital insurance is of the home you bought. This is likely not applicable to LUC students.

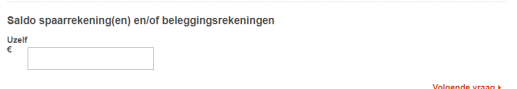

Step 26: Fill in the amount of money you have on your bank account (s).

Step 27: Fill in the amountof money you have on your saving account (s).

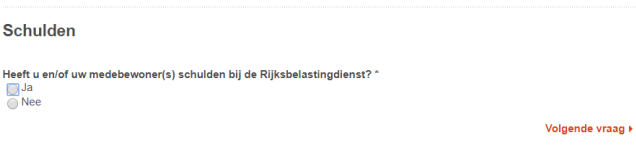

Step 28: Fill in whether you or your roommates have debts or not.

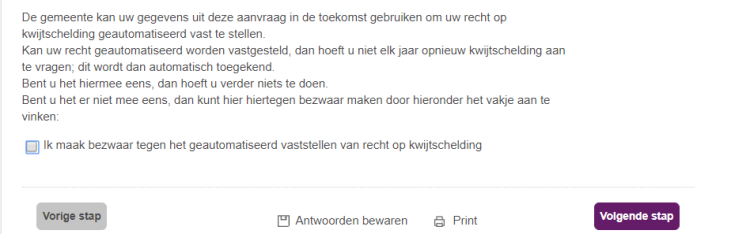

Step 29: Fill in whether you disagree with the government using your data automatically for determining whether you have the right for waste waiver. If you disagree, click on the box. If you do not mind, click on ‘volgende stap’.

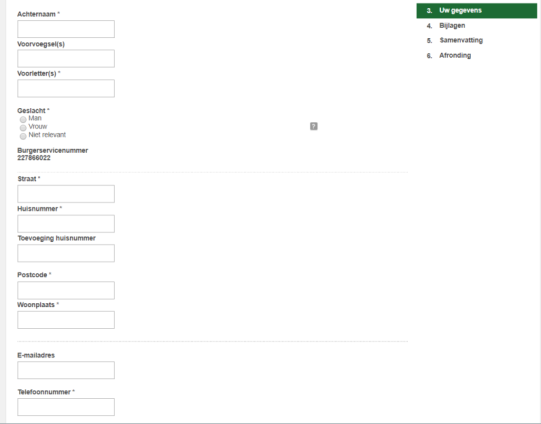

Step 30: Fill in your personal information.

Surname

Initials

Sex

Street

Roomnumber

Postal Code

City you live in

Mobile phone number

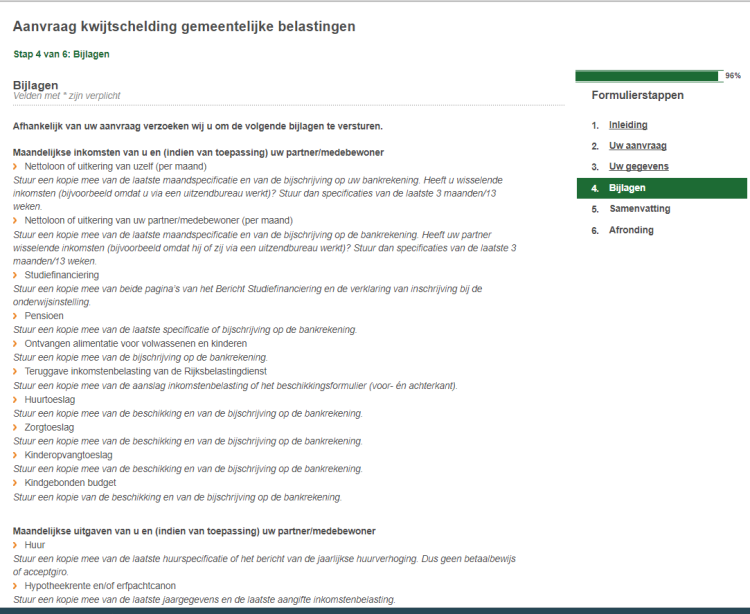

Step 31: Documents you need to send. Translation below.

Translation of relevant documents you need to send:

- Send the most recent overview of your income (payroll). Do you have a fluctuating income? Then you have to send the overview of the last three months. If you live in a shared room, you also need to send the other persons documents concerning income

- Send declaration of admission at LUC from the year you’re in and a copy of both pages from the Message Study Finances.

- Send both sides of your income tax assessment

- Most recent proof of rent benefit and health benefit

- You can find this proof at mijn.toeslagen.nl under ‘Mijn beschikkingen’. The document is called ‘Voorblad’

- This also includes at least two proofs of payment

- Renting contract including the breakdown of the costs

- Overview of the health premium from your insurer (polisblad)

- A proof that shows the balance of all your bank accounts

At the bottom select whether you want to send these documents digital or by mail.